-

Marten Transport Announces Third Quarter Results

来源: Nasdaq GlobeNewswire / 19 10月 2021 16:01:00 America/New_York

MONDOVI, Wis., Oct. 19, 2021 (GLOBE NEWSWIRE) -- Marten Transport, Ltd. (Nasdaq/GS:MRTN) today reported a 17.9% improvement in net income to $21.3 million, or 26 cents per diluted share, for the third quarter ended September 30, 2021, from $18.0 million, or 22 cents per diluted share, for the third quarter of 2020. For the first nine months of 2021, net income improved 21.6% to $60.7 million, or 73 cents per diluted share, from $49.9 million, or 60 cents per diluted share, for the first nine months of 2020.

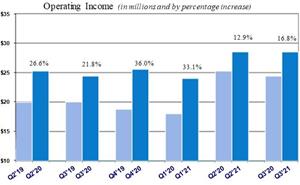

Operating Results Comparison Percentage Percentage Percentage Percentage Increase Increase Increase Increase Three Months Nine Months Year Year Ended Ended Ended Ended September 30, September 30, December 31, December 31, 2021 vs. 2020 2021 vs. 2020 2020 vs. 2019 2019 vs. 2018 Operating revenue 16.3 % 9.2 % 3.7 % 7.1 % Operating revenue, net of fuel surcharges 12.8 % 6.8 % 6.8 % 8.6 % Operating income 16.8 % 19.7 % 21.9 % 8.7 % Net income 17.9 % 21.6 % 13.8 % 11.0 % Operating revenue improved 16.3% to a record $251.3 million for the third quarter of 2021 from $216.0 million for the third quarter of 2020, and improved 9.2% to $706.8 million for the first nine months of 2021 from $647.0 million for the first nine months of 2020. Excluding fuel surcharges, operating revenue improved 12.8% to $221.2 million for the 2021 quarter from $196.1 million for the 2020 quarter, and improved 6.8% to $623.0 million for the first nine months of 2021 from $583.6 million for the first nine months of 2020. Fuel surcharge revenue increased to $30.1 million for the 2021 quarter from $19.9 million for the 2020 quarter, and increased to $83.7 million for the first nine months of 2021 from $63.5 million for the first nine months of 2020 due to significantly higher fuel prices.

Operating income improved 16.8% to $28.5 million for the third quarter of 2021 from $24.4 million for the third quarter of 2020. Operating income improved 19.7% to $81.0 million for the first nine months of 2021 from $67.7 million for the first nine months of 2020.

Operating expenses as a percentage of operating revenue were 88.7% for each of the third quarters of 2021 and 2020. Operating expenses as a percentage of operating revenue, with both amounts net of fuel surcharges, improved to 87.1% for the third quarter of 2021 from 87.6% for the third quarter of 2020.

Operating expenses as a percentage of operating revenue improved to 88.5% for the first nine months of 2021 from 89.5% for the first nine months of 2020. Operating expenses as a percentage of operating revenue, with both amounts net of fuel surcharges, improved to 87.0% from 88.4%.

Executive Chairman Randolph L. Marten said, “Marten’s talented and dedicated people continue to drive our consistent profitable growth. This quarter is yet another quarter over the last year and a half during the pandemic where we produced strong operating income improvement.”

“We have been heightening and will continue to heighten our emphasis on structurally improving our drivers’ jobs and work-life balance by collaborating with our customers, while also increasing our driver compensation. Our approach, which I mentioned in our second quarter earnings release, is working despite the unrelenting national shortage of qualified drivers. With our peoples’ smart, hard work, we began the fourth quarter with 181 more of the industry’s top drivers than we employed at the beginning of the third quarter. Additionally, we increased our number of refrigerated containers by 53 during the third quarter, expanding our fleet to 607 containers at September 30th.”

“We are confident in our ability to continue to deliver profitable growth. Success breeds success.”

Marten Transport, with headquarters in Mondovi, Wis., is a multifaceted business offering a network of refrigerated and dry truck-based transportation capabilities across the Company’s five distinct business platforms - Truckload, Dedicated, Intermodal, Brokerage and MRTN de Mexico. Marten is one of the leading temperature-sensitive truckload carriers in the United States, specializing in transporting and distributing food, beverages and other consumer packaged goods that require a temperature-controlled or insulated environment. The Company offers service in the United States, Canada and Mexico, concentrating on expedited movements for high-volume customers. Marten’s common stock is traded on the Nasdaq Global Select Market under the symbol MRTN.

This press release contains certain statements that may be considered forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements include a discussion of Marten’s prospects for future growth and by their nature involve substantial risks and uncertainties, and actual results may differ materially from those expressed in such forward-looking statements. Important factors known to the Company that could cause actual results to differ materially from those discussed in the forward-looking statements are discussed in Part I, Item 1A of the Company’s Annual Report on Form 10-K for the year ended December 31, 2020. The Company undertakes no obligation to correct or update any forward-looking statements, whether as a result of new information, future events or otherwise.

CONTACTS: Tim Kohl, Chief Executive Officer, and Jim Hinnendael, Executive Vice President and Chief Financial Officer, of Marten Transport, Ltd., 715-926-4216.

MARTEN TRANSPORT, LTD.

CONSOLIDATED CONDENSED BALANCE SHEETSSeptember 30, December 31, (In thousands, except share information) 2021 2020 (Unaudited) ASSETS Current assets: Cash and cash equivalents $ 83,900 $ 66,127 Receivables: Trade, net 99,686 83,426 Other 6,208 4,202 Prepaid expenses and other 22,150 21,903 Total current assets 211,944 175,658 Property and equipment: Revenue equipment, buildings and land, office equipment and other 957,708 930,123 Accumulated depreciation (267,808 ) (275,950 ) Net property and equipment 689,900 654,173 Other noncurrent assets 1,539 1,805 Total assets $ 903,383 $ 831,636 LIABILITIES AND STOCKHOLDERS’ EQUITY Current liabilities: Accounts payable $ 33,687 $ 25,702 Insurance and claims accruals 41,128 39,595 Accrued and other current liabilities 32,667 24,497 Accrued dividends 44,789 - Total current liabilities 152,271 89,794 Deferred income taxes 120,689 121,098 Noncurrent operating lease liabilities 336 411 Total liabilities 273,296 211,303 Stockholders’ equity: Preferred stock, $.01 par value per share; 2,000,000 shares authorized; no shares issued and outstanding - - Common stock, $.01 par value per share; 192,000,000 shares authorized; 82,942,839 shares at September 30, 2021, and 82,705,005 shares at December 31, 2020, issued and outstanding 829 827 Additional paid-in capital 85,539 85,070 Retained earnings 543,719 534,436 Total stockholders’ equity 630,087 620,333 Total liabilities and stockholders’ equity $ 903,383 $ 831,636 MARTEN TRANSPORT, LTD.

CONSOLIDATED CONDENSED STATEMENTS OF OPERATIONS

(Unaudited)Three Months Nine Months Ended September 30, Ended September 30, (In thousands, except per share information) 2021 2020 2021 2020 Operating revenue $ 251,280 $ 216,011 $ 706,768 $ 647,041 Operating expenses (income): Salaries, wages and benefits 81,091 74,797 229,385 221,034 Purchased transportation 52,861 37,066 138,629 113,676 Fuel and fuel taxes 33,909 24,268 94,853 73,433 Supplies and maintenance 11,685 12,440 33,867 36,501 Depreciation 25,371 25,580 76,598 76,979 Operating taxes and licenses 2,606 2,749 8,036 8,003 Insurance and claims 10,501 11,243 31,338 35,160 Communications and utilities 2,181 1,999 6,320 5,961 Gain on disposition of revenue equipment (4,536 ) (2,128 ) (11,859 ) (5,899 ) Gain on disposition of facility - (1,718 ) - (1,718 ) Other 7,115 5,315 18,589 16,223 Total operating expenses 222,784 191,611 625,756 579,353 Operating income 28,496 24,400 81,012 67,688 Other (8 ) (17 ) (27 ) (127 ) Income before income taxes 28,504 24,417 81,039 67,815 Income taxes expense 7,230 6,373 20,341 17,919 Net income $ 21,274 $ 18,044 $ 60,698 $ 49,896 Basic earnings per common share $ 0.26 $ 0.22 $ 0.73 $ 0.61 Diluted earnings per common share $ 0.26 $ 0.22 $ 0.73 $ 0.60 Dividends paid per common share $ - $ 0.04 $ 0.08 $ 0.093 Dividends declared per common share $ 0.54 $ 0.04 $ 0.62 $ 0.093 MARTEN TRANSPORT, LTD.

SEGMENT INFORMATION

(Unaudited)Dollar Percentage Change Change Three Months Three Months Three Months Ended Ended Ended September 30, September 30, September 30, (Dollars in thousands) 2021 2020 2021 vs. 2020 2021 vs. 2020 Operating revenue: Truckload revenue, net of fuel surcharge revenue $ 86,889 $ 85,074 $ 1,815 2.1 % Truckload fuel surcharge revenue 12,728 8,549 4,179 48.9 Total Truckload revenue 99,617 93,623 5,994 6.4 Dedicated revenue, net of fuel surcharge revenue 68,826 69,002 (176 ) (0.3 ) Dedicated fuel surcharge revenue 13,336 9,335 4,001 42.9 Total Dedicated revenue 82,162 78,337 3,825 4.9 Intermodal revenue, net of fuel surcharge revenue 22,716 19,991 2,725 13.6 Intermodal fuel surcharge revenue 4,031 1,985 2,046 103.1 Total Intermodal revenue 26,747 21,976 4,771 21.7 Brokerage revenue 42,754 22,075 20,679 93.7 Total operating revenue $ 251,280 $ 216,011 $ 35,269 16.3 % Operating income: Truckload $ 11,670 $ 10,546 $ 1,124 10.7 % Dedicated 8,521 11,024 (2,503 ) (22.7 ) Intermodal 2,840 1,304 1,536 117.8 Brokerage 5,465 1,526 3,939 258.1 Total operating income $ 28,496 $ 24,400 $ 4,096 16.8 % Operating ratio: Truckload 88.3 % 88.7 % Dedicated 89.6 85.9 Intermodal 89.4 94.1 Brokerage 87.2 93.1 Consolidated operating ratio 88.7 % 88.7 % MARTEN TRANSPORT, LTD.

SEGMENT INFORMATION

(Unaudited)Dollar Percentage Change Change Nine Months Nine Months Nine Months Ended Ended Ended September 30, September 30, September 30, (Dollars in thousands) 2021 2020 2021 vs. 2020 2021 vs. 2020 Operating revenue: Truckload revenue, net of fuel surcharge revenue $ 254,441 $ 254,897 $ (456 ) (0.2 )% Truckload fuel surcharge revenue 36,032 28,058 7,974 28.4 Total Truckload revenue 290,473 282,955 7,518 2.7 Dedicated revenue, net of fuel surcharge revenue 202,955 200,237 2,718 1.4 Dedicated fuel surcharge revenue 37,565 28,564 9,001 31.5 Total Dedicated revenue 240,520 228,801 11,719 5.1 Intermodal revenue, net of fuel surcharge revenue 64,193 59,127 5,066 8.6 Intermodal fuel surcharge revenue 10,150 6,830 3,320 48.6 Total Intermodal revenue 74,343 65,957 8,386 12.7 Brokerage revenue 101,432 69,328 32,104 46.3 Total operating revenue $ 706,768 $ 647,041 $ 59,727 9.2 % Operating income: Truckload $ 36,282 $ 28,367 $ 7,915 27.9 % Dedicated 28,074 31,009 (2,935 ) (9.5 ) Intermodal 6,151 3,564 2,587 72.6 Brokerage 10,505 4,748 5,757 121.3 Total operating income $ 81,012 $ 67,688 $ 13,324 19.7 % Operating ratio: Truckload 87.5 % 90.0 % Dedicated 88.3 86.4 Intermodal 91.7 94.6 Brokerage 89.6 93.2 Consolidated operating ratio 88.5 % 89.5 %

MARTEN TRANSPORT, LTD.

OPERATING STATISTICS

(Unaudited)Three Months Nine Months Ended September 30, Ended September 30, 2021 2020 2021 2020 Truckload Segment: Revenue (in thousands) $ 99,617 $ 93,623 $ 290,473 $ 282,955 Average revenue, net of fuel surcharges, per tractor per week(1) $ 4,411 $ 3,955 $ 4,202 $ 3,865 Average tractors(1) 1,499 1,637 1,553 1,685 Average miles per trip 502 546 516 554 Non-revenue miles percentage(2) 10.1 % 10.2 % 10.0 % 10.8 % Total miles (in thousands) 35,945 41,210 111,513 125,082 Dedicated Segment: Revenue (in thousands) $ 82,162 $ 78,337 $ 240,520 $ 228,801 Average revenue, net of fuel surcharges, per tractor per week(1) $ 3,438 $ 3,295 $ 3,305 $ 3,304 Average tractors(1) 1,523 1,593 1,574 1,548 Average miles per trip 328 304 319 306 Non-revenue miles percentage(2) 1.1 % 0.7 % 1.0 % 0.7 % Total miles (in thousands) 31,511 33,843 95,765 98,553 Intermodal Segment: Revenue (in thousands) $ 26,747 $ 21,976 $ 74,343 $ 65,957 Loads 8,257 9,306 24,885 27,736 Average tractors 139 99 140 99 Brokerage Segment: Revenue (in thousands) $ 42,754 $ 22,075 $ 101,432 $ 69,328 Loads 18,251 13,670 47,167 45,058 At September 30, 2021 and September 30, 2020: Total tractors(1) 3,204 3,329 Average age of company tractors (in years) 1.4 1.7 Total trailers 5,291 5,368 Average age of company trailers (in years) 3.2 2.9 Ratio of trailers to tractors(1) 1.7 1.6 Total refrigerated containers 607 401 Three Months Nine Months Ended September 30, Ended September 30, (In thousands) 2021 2020 2021 2020 Net cash provided by operating activities $ 44,544 $ 50,640 $ 127,909 $ 154,707 Net cash (used for) investing activities (40,704 ) (34,558 ) (102,142 ) (93,748 ) Net cash (used for) financing activities (612 ) (3,126 ) (7,994 ) (4,141 ) Weighted average shares outstanding: Basic 82,907 82,672 82,835 82,472 Diluted 83,372 83,279 83,380 83,098 (1 ) Includes tractors driven by both company-employed drivers and independent contractors. Independent contractors provided 101 and 132 tractors as of September 30, 2021 and 2020, respectively. (2 ) Represents the percentage of miles for which the company is not compensated. A graphic accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/62731d52-45d0-495b-b904-8b9e15d654d9